Budgeting for Your Home

- Hannah Mason

- Mar 5, 2022

- 9 min read

Creating a beautiful home starts with ensuring you have the money for it. I love having a stunning space to live in (as many do) but I never recommend going out and buying a hundred items to decorate and fill your home without ensuring your bank account can live up to the cost of those items first.

Budgeting can be scary. If you are just starting out (like I am) there are a lot of things you'll need to buy from furniture to pots and pans to toilet brushes and everything in between. Items for your home can add up fast especially if you don't set money aside, plan, and think ahead about which items can be thrifted and which cannot. It's all a little overwhelming and I am by no means claiming to be an expert but I will take you through the steps I took as I set out to budget for my own apartment supplies for my family's East Coast move.

Step One: Plan Your Rooms

I don't actually know how many rooms I am going to have in the East Coast but hopefully, you do. If not, perhaps, you have an idea of how many rooms you want to have when you move into your new home. Are you already searching for a home on Zillow or whatever other home searching tool you may use? how many bedrooms, bathrooms, and other rooms are you looking for? Start to list them out.

For example:

I know I will have. a bedroom in the East Coast. In fact, it quite possibly the only room I can be sure I will have (though we are looking at homes with some kind of apartment for me). So that is the first "room" that goes on the list. After the bedroom, I can list the bathroom as any "apartment" needs a bathroom. The goal is to find an apartment that also has a kitchen and living space so these are rooms I have listed as well. Finally, my list of "rooms" includes "general/decor" for organization purposes. Any items that don't fit in a singular room can fit under this banner.

Thus, my list:

Bedroom

Bathroom

Living Room

Kitchen/Dining Room

General/Decor

What will these "rooms" be used for?

As you budget, you are going to quickly accumulate a long list of items that will need to be budgeted for. I find it easiest to organize these by "rooms" for two reasons:

If I happen to not have a "room" (say, a kitchen) in my apartment space, I can go back and delete all the items that correspond to that room. In the same way, if you organized your space according to rooms and found that you ended up buying a home with only 3 bedrooms (instead of four) you could delete the items you thought you might need for the fourth bedroom.

Organizing things this way helps with the next step. I eventually need to use this list to begin buying things. Having the list organized by room helps for this step so that when I go to buy items I can quickly find what I budgeted for my kitchen utensils or my mattress by looking for the room they are in.

Step Two: Create A Chart

I find the best way to organize anything is a chart. I like the simplicity of seeing things on paper (or online) in an easy-to-read format that lets me find all the information I need in one document. Thus, for something like budgeting for a home, I create a chart. You can download the chart I used for budgeting at the bottom of this post. It looks a little something like this:

Item: | Room: | Subdivision: | Necessity (1-5): | Price: | Notes: |

Table | Kitchen | furniture | 4 | $10 | |

Couch | Living | furniture | 4 | $200 | |

Let's talk a little bit about the chart:

Obviously, we have the item and the room. These are reasonably self-explanatory as the item we are budgeting for is perhaps the most important part of the equation and I just described why we must organize these items into rooms.

I like to also organize items by subdivisions. It has likely been made clear to you if you have been reading the blog for any amount of time that I like to organize, organize, organize so this should come as no surprise to you. Subdivisions, I feel, are unnecessary but add an extra layer of organization that helps to sort through the mess that is budgeting. Similar to the "rooms" they help to find items when there is a huge list of them.

I would highly suggest also adding the "necessity" section to your chart. If you have a small budget you are working with, rating the items on your list by necessity will help you to determine which to buy first and which can be left out if you run out of money. I gave myself a scale of 1-5 (with 5 being absolutely necessary and 1 being I could do without this) and rated things like cutlery and a bed 5 while throw pillows and other decoration items received 2-3.

I'll discuss how to choose a price for your items later but budgeting will require that you work out how much to set aside for each item (after all, this is the essence of budgeting). I also wrote notes for many of my items. For example, I hope to have a dining area similar to the one below. For this, I will need a bench and, thus, budgeted for this item. However, I already own a beautiful trunk that could serve as the bench provided the space is the correct shape and I noted this in my notes section. This would, of course, save me money and time.

Step Three: List Items

Now, with your chart ready, you can begin to plug in your items. Ignore the price column for now and just start by listing out all the items that you can think of for your home. Start with the bigger items (such as furniture) before you move onto smaller items and group things like decor, and kitchen utensils together. You don't want to spend hours listing out each kitchen utensil that you want to buy. That will quickly get tiring.

I would highly suggest creating this list by going through the rooms that you identified earlier. Start by listing the furniture that you want in your living room (couches, end tables, ottomans, etc.) then the bedroom/s (dressers, beds, nightstands), the dining room (table, chairs), and the kitchen (bar stools, kitchen island, etc.). You likely won't have furniture in the bathroom so come back around to that but if you have any other rooms (an office, gym, nursery, etc.) you could enter the furniture for those as well.

Once all the furniture is listed, start to add other more expensive items and groups of items, continuing to go room by room. This could include things like plants (real or fake), decor, bookends, throw pillows/blankets, duvet sets, knife sets, cutlery, plates, bowls, organization tools (baskets, boxes, hangers, dividers, etc.), towels, kitchen utensils, cooking trays, cutting boards, and more. The list will be different for each house depending on what rooms you need to fill and what you are bringing into it from your previous abode. Do your best to not forget items (lumping all those random items into groups like "kitchen utensils" and "decor" can help with this) so that you don't end up over budget.

Step Four: Pricing

I won't lie. This is the hardest part. While you don't want to overestimate to the point of being overwhelmed with the task at hand so that you feel as if you could never afford your dream home, you absolutely CAN NOT underestimate the prices of your items.

I'm serious.

The result of overestimating (aside from a little hopelessness) is having a little extra cash in your pocket when you actually buy the items. Cash that you could use if something goes wrong, prices rise on something, or you make a terrible mistake and your item is beyond repair.

In contrast, if you underestimate the price of your item, you will end up over budget or without the item you so desperately wanted (or worse...needed).

So how do you ensure that you put the right estimate on all those items that you just listed out? I have three rules for this:

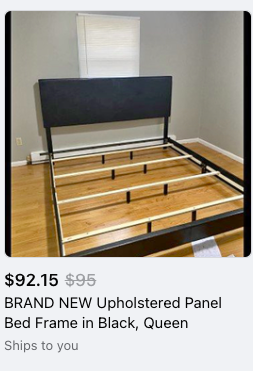

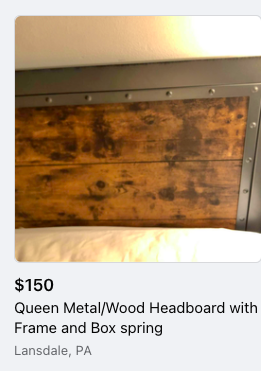

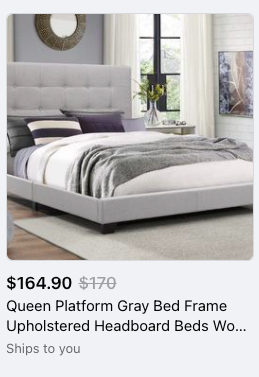

RESEARCH, RESEARCH, RESEARCH! Guestimating with nothing to back up your hunch will get you nowhere. Researching your hunch and getting a really good idea of the prices of the item you are looking for will get you everywhere. Let me give you an example. I want to buy a queen bed for my bedroom in the East Coast (probably!). I don't plan on buying it at full price. This, admittedly, makes the research harder but not impossible. I can't know for sure what price I will be able to buy my bed at because anything secondhand available to me right now will be unavailable when I look again in June.

That doesn't mean I can't take a good estimate from the prices of the ones available now, however.

When I have a look at the bed frames available (near Doylestown), I can see that there are plenty available for $100-$150. I am reasonably confident I could find something for less than $100 when the time comes (even if it is a simple frame and a DIY headboard) but, taking these prices into account, I set my price estimate for the queen bed frame at $200 leaving plenty of wiggle room.

Know whether you want to buy the item full-price or second-hand. The bed frame is a great example of one of the items I plan to buy second-hand but I won't be buying everything second-hand and, when budgeting, it is important to know which route you want to go. Second-hand items will be cheaper but will (most often) be "used" in some way. This could mean dents, scratches, breaks, or bends. It could mean things that need fixing or it could mean a piece of furniture is outdated and needs a new paint job.

It can also mean it's beyond repair.

Know when to buy first-hand and when first-hand items will be the better choice. Some things I never buy second-hand:

My favorite headphones (pansonic earbuds)

Underwear and socks (that a no-brainer!)

Old Navy Jeans (you just have to have the perfect fit!)

Converse look-alikes (I buy them about once a year and they have hols before the next pair arrives!)

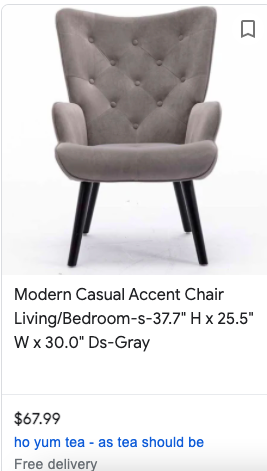

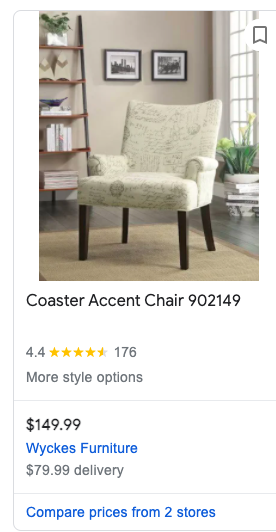

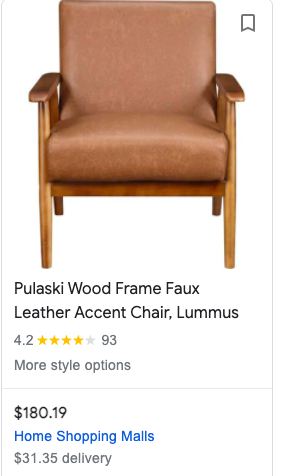

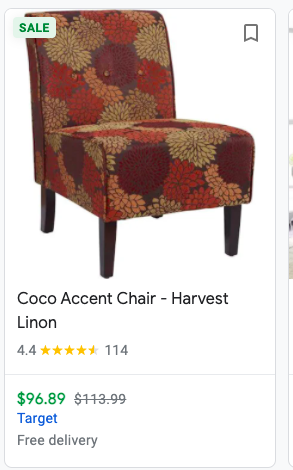

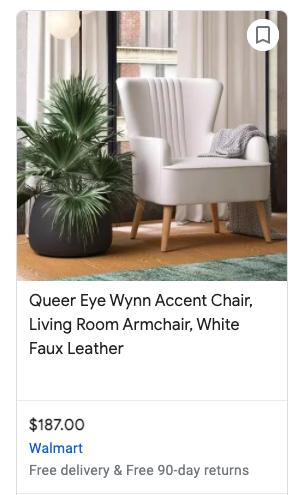

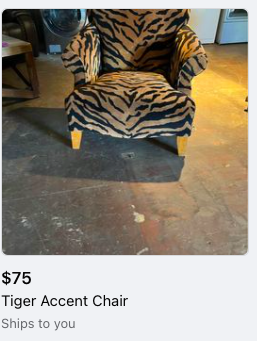

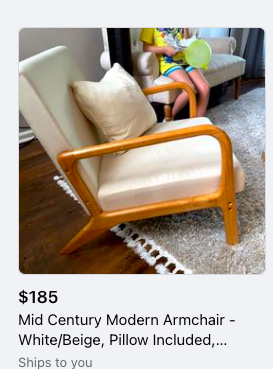

Similarly, some items for the home are better bought first hand. I plan to buy my accent chairs first hand though they may be some of the most expensive items I buy. Buying them first hand will give me more choice and

mean what I get is much better quality than anything I could find second-hand.

Plus, second-hand prices often match the prices of first-hand chairs.

Plan for more, not less. This is a bit of a restatement of what I said earlier: DON'T ever underestimate. But I want to elaborate on that. How do you ensure you aren't underestimating? Let's do a few exercises to be sure:

First, something second-hand. I may possibly need a dresser so I added one to my budget. I researched second-hand dressers as I know I could quickly update a second-hand dresser with a fresh coat of paint or stain and some new hardware.

These second-hand dressers covered quite a range with the cheapest being $40 and the most expensive (in this picture) being $95.04. I am not one to pick the most expensive thing. In fact, if I know that the cheaper alternative can be fixed up with a little elbow grease and a coat of paint, I tend to be more likely to choose something cheaper.

So what did I put into my budget?

Not $40, that's for sure! Even though there are two dressers being sold for $40 (and 4 for $50) I have no way of knowing how steady these prices will be. Instead, I am better to take a good look at the prices on the dressers available and then budget for a much higher price...just in case. Worst case scenario, I have to use all the money I budgeted. Best case scenario, I use 1/2 (or less) and can put the leftover money towards something I didn't budget enough for, want to put more into (or just into my savings!).

In case you were still wondering, $100 was what I set aside for the dresser.

What about something that I might buy online? These prices are likely to be more stable (though not entirely especially over a 4 month period). While second-hand dresser prices could change from $40 to $100 in that time, online prices for items, depending on the item, aren't likely to fluctuate quite as much.

Let's take a duvet set as an example. Here are some potential options for the sets I could buy. Since I'll be abandoning my duvet in Redding, I'll need to ship my duvet to my new home on the East Coast in hopes that it arrives as I do.

The duvet set on the left is while the duvet set on the right is $36.99 and similar sets are in the same price range. However, the amount I budgeted for my duvet set (a set which I desire to be very simple) is $60.

Step Five: Totalling it Up

At last we have come t the final step in our budgeting journey! While calculating the totals of your budget isn't exciting, difficult, or scary, I wouldn't underestimate the importance of it. In fact, it is the total of your budget that you need to know perhaps the most so you can get an idea of how much of your project you can afford, how much you need to begin saving to begin your project, and what each of your rooms in your house will cost.

I recommend using excel or google sheets for this process. Both will allow you to easily calculate costs without getting lost plugging numbers into a calculator (which was the last one you plugged in??). You'll see on the download I've provided that my totals calculation chart is divided into rooms again. This allows you to see how much each room is adding up to. You can then reassess the cost of a room if one, in particular, is getting expensive or take room out altogether based on the costs. It also allows you to subtract room totals from your overall cost if a particular room won't be a part of your household after all.

Good luck with your budgeting, I wish you all the best!

Comments